So, after 14 days of testing, you’ve decided to use the oki-toki service for your business, the last step remains – top up your balance and you can start working. To ensure maximum efficiency, it’s important to set up payments and choose the optimal payment methods. In this article, we’ve step-by-step described how to set up the payer and choose the most convenient method for you.

How to set up the payer

Before we move on to paying for services, let’s figure out how to set up your payer:In your oki-toki account, go to the Documents and payments section and add a payer. Here you need to choose the type of payer: individual or legal entity.

Individual

If you’re an individual, fill in all the fields and the mandatory “E-mail” field. This will allow the oki-toki system to identify the sender of funds and automatically credit them to your balance.

Legal entity

If you represent a legal entity, when paying through a checking account, correctly specify the payer’s details, so that when the payment arrives, the system automatically determines that this payment belongs to your company.Also, pay attention to the following fields that need to be filled out, as they are used in the acts and invoices for payment:

- Short and full name of the company;

- Legal address;

- Unique identification number of the legal entity;

- Contact information: Your contact phone number and email address will ensure easy communication if necessary.

Besides setting up the payer, it’s also important to correctly fill out the “Sample act of completed services”. This will help you simplify the process of creating acts of completed services, as well as form them without unnecessary difficulties and discrepancies. Efficient documentation management contributes to smoother and more accurate financial accounting.

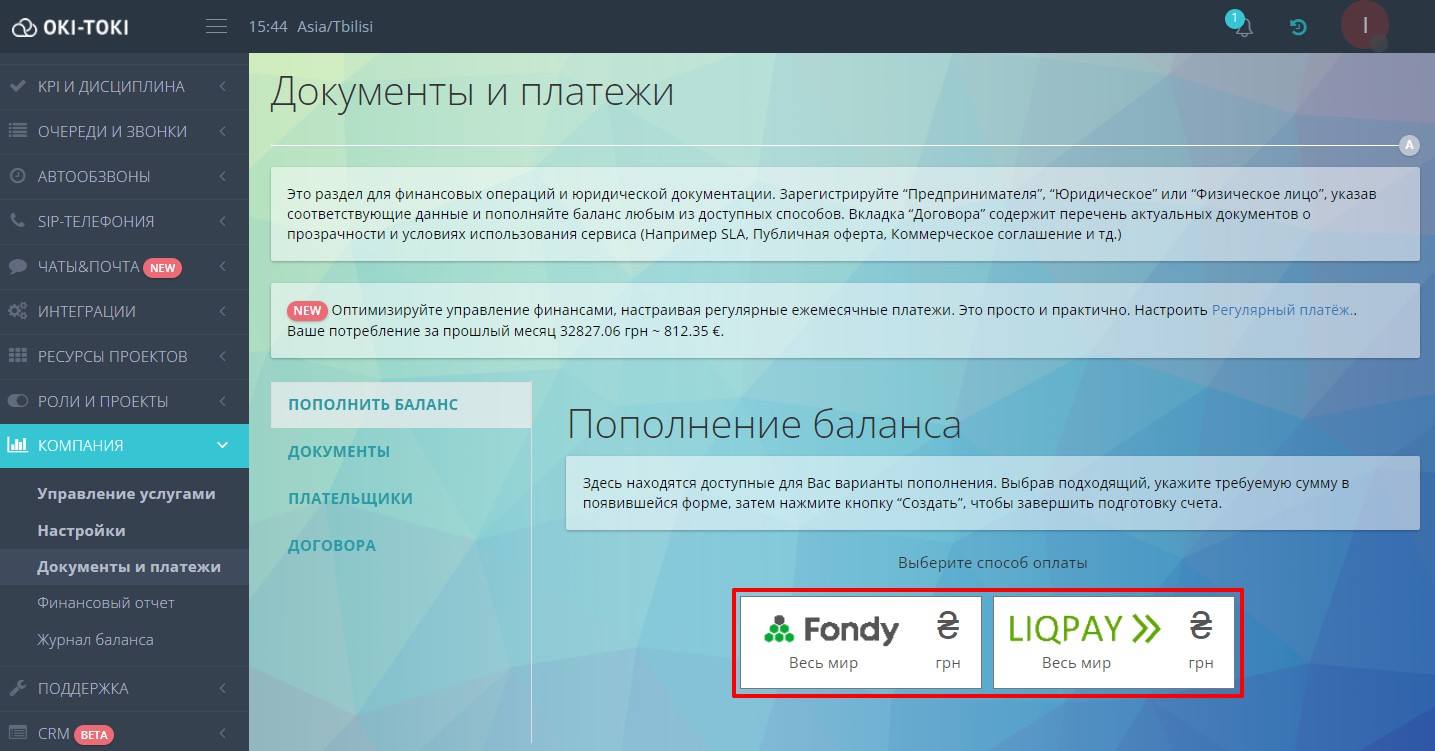

Choosing the optimal payment method:

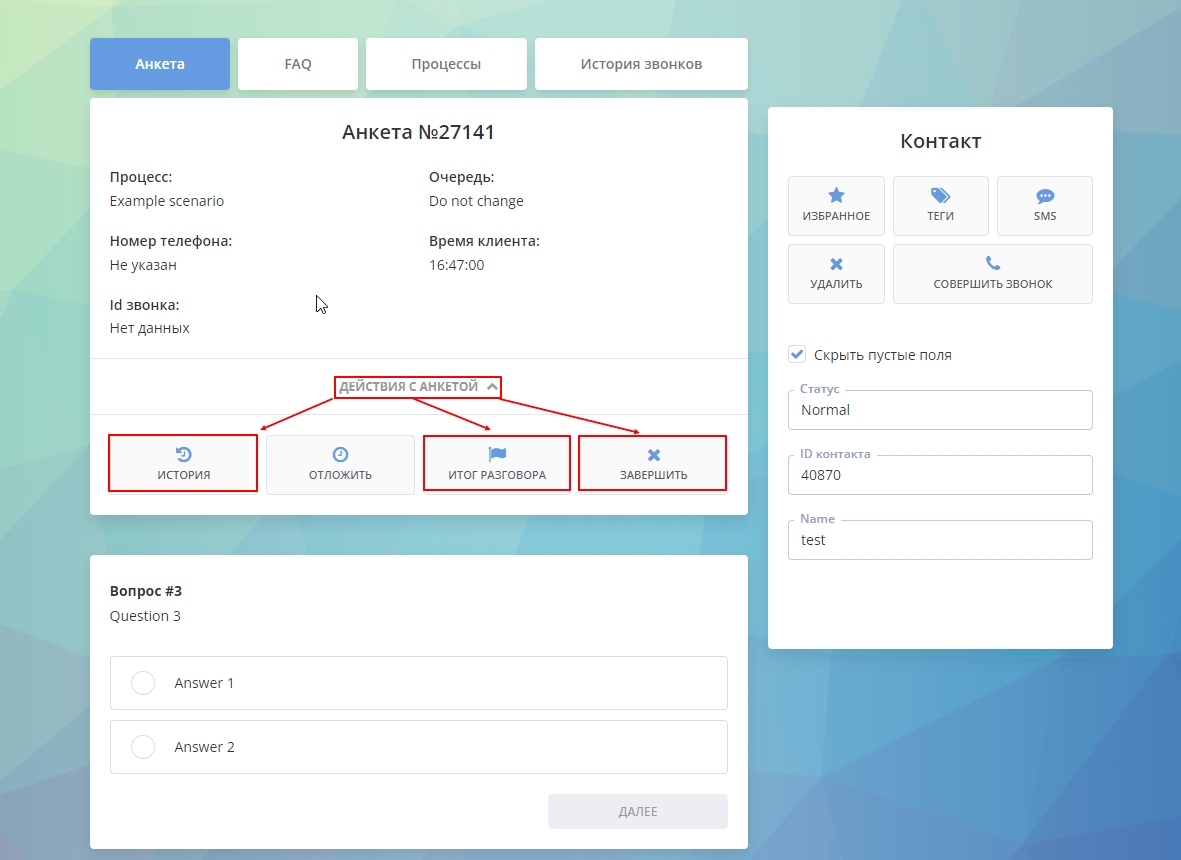

Now, when the payer setting is complete, let’s consider the different payment methods and choose the most convenient for you.To make a payment, go to the “Top up balance” menu and select the payment method. Here are the available options for topping up your balance.

Having chosen the suitable one, specify the required amount in the form that appears, then click “Create” to finish preparing the invoice. Properly configured payments will help you focus on more important aspects of your business or personal finances.

Regular payment

To make the payment process most convenient, set up a regular payment, this will help optimize the payment process, eliminating cases when you forgot to pay for the service.If your oki-toki account still runs out of funds, you can always use a credit.

Journal of documents and payments

The journal of documents and payments is a tool for accounting for financial transactions and monitoring the financial state of the organization. It stores acts and bills for the selected period, allowing you to see all your financial transactions.Through this tool, oki-toki easily pays bills. If you prefer electronic payments – you can immediately pay the bill online. And if you prefer the traditional approach, you can download the bill and pay it at the bank. This is convenient and allows you to adapt to various financial management methods and make the payment process as flexible as possible.Thus, oki-toki not only ensures control and accounting of financial transactions but also makes payment simple and convenient for your business processes.

Balance journal and financial report

The balance journal and financial report are integral tools in financial management and serve several important purposes:

- First, they show changes in your balance, detailing for which services there were debits from the account in oki-toki, as well as the amounts of top-ups during the period you selected.

- Secondly, through these reports, you can monitor finances spent on maintaining the call center over the period, which helps control expenses and plan the budget more effectively.

These reports play a key role in effective financial management and planning expenses for oki-toki service costs.